free cash flow yield explained

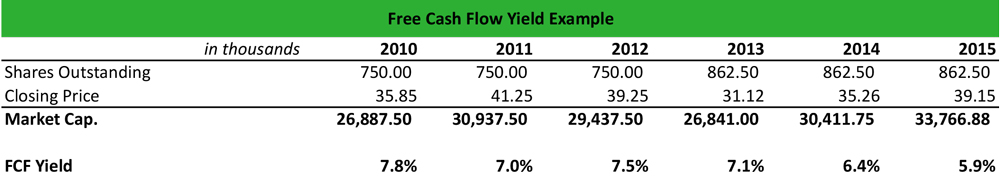

It is computed as the product of the total number of outstanding shares and the price of each share. The equity shareholders Equity Shareholders Shareholders equity is the.

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

EBITDA 45m EBIT 8m D.

. Although IRR and MoM often reign supreme as the most popular private equity return metrics Free Cash Flow Yield is also a very powerful investment metric. In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed. Heres the fun part.

The ratio of Free Cash Flow to a companys enterprise value FCF Enterprise Value. FCF Yield is the answer. There are various ways to compute for FCF although they should all give the same results.

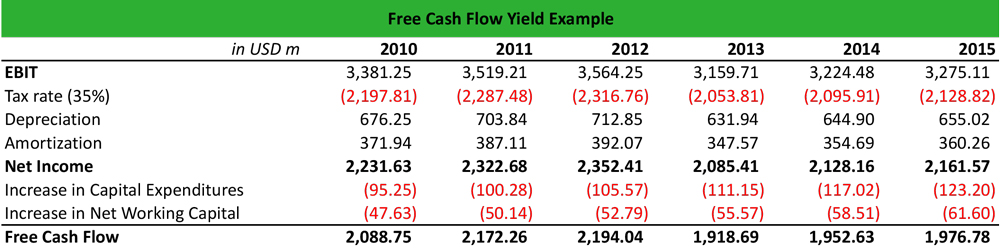

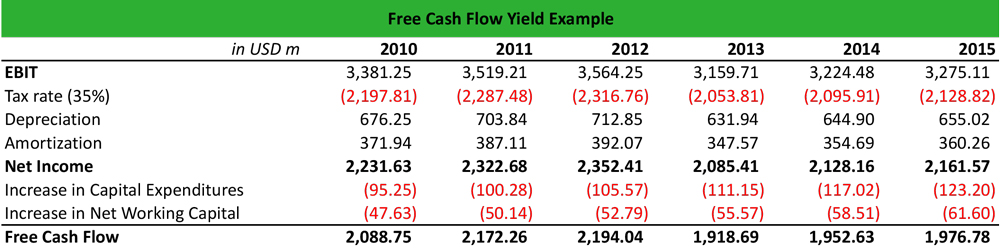

To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital. We can use the FCF Yield to rank all stocks on an apples-to. Key Takeaways A higher free cash flow yield is ideal because it means a company has enough cash flow to satisfy all of its obligations.

What is the definition. Example of Free Cash Flow. These High-Yield Stocks Are.

Valuation metrics offer investors a simple way to assess a companys worth by looking at its sales earnings and cash flow. Free Cash Flow Explained. What Does Free Cash Flow Yield Mean.

Though the company looks profitable in the. Free cash flow FCF is the owners net cash income generated by a company after adjusting for all non-cash transactions new debt and Capex. If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share.

What is Free Cash Flow Yield FCFY Calculation of Free Cash Flow Yield FCFY. In the next step we can calculate the free cash flow CFO Capex and EBITDA. If the free cash flow yield is low it means investors arent receiving a very good return on the money theyre.

Free Cash Flow Yield Explained. For the rest of the. The Free Cash Flow Yield Cash Flow Yield.

Free Cash Flow Yield is a metric that measures how much free cash flow the company generated for investors relative to the price that investors have to pay to buy their. Read more divided by its total free cash flow. Free Cash Flow Yield.

When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model. Free cash flow yield or FCF yield is a valuation metric to measure the yield of a firms free cash compared to its size. Free Cash Flow Yield FCFY We can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis.

Free Cash Flow 50m CFO 10m Capex 40m. In this weeks short video I explain how it works. Free cash flow yield is a financial ratio which measures that how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow.

Thats 2 the same as the bond. The free cash flow yield gives investors an idea. Free cash flow yield is widely quoted by analysts and gives investors a useful insight into whether a share is cheap or expensive.

Httpsamznto35cbAn0Favorite Wealth Building Book. Free cash flow yield is really just the companys free cash flow divided by its market value. Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to.

What free cash flow means for a company and why investors should definitely look at it before buying in. The free cash flow yield FCFY is a financial solvency metric that compares a companys predicted free cash flow per share to its market value per share. The formula below is a simple and the most commonly used formula for levered free cash flow.

Free Cash Flow Yield - Michael Mack Portfolio Manager. Free Cash Flow Yield Free.

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Yield Formula Top Example Fcfy Calculation

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Free Cash Flow Uses One Of The Most Important Metrics In Finance

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)